Take A Breath Easier With These Home Mortgage Tips

Content by-Wheeler BonnerIt's difficult to deal with technicalities of financing your home. There is just click the following post to be devoured as part of the mortgage process. You should keep reading to learn more about mortgages and educate yourself before you apply for one.

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. https://www.chase.com/business/payments/smart-pos is for you to try to improve your credit before you apply for mortgage loan.

Pay down your debt, then avoid adding new debt when trying to get a home loan. The lower your debt is, the higher a mortgage loan you can qualify for. High debt could actually cause your application to be denied. Having too much debt can also cause the rates to be higher on any loans offered to you, too.

Reducing your debt as much as possible will increase your chances of being approved for a mortgage. If you are not in a good financial situation, meet with a debt consolidation professional to get out of debt as quickly as possible. You do not need to have a zero balance on your credit cards to get a mortgage but being deeply in debt is definitely a red flag.

Consider the Federal Housing Authority to be your first stop when looking for a new mortgage. In most cases, a mortgage with the FHA will mean putting a lot less money down. If you opt for a conventional loan, you will be required to come up with a serious down payment, and that can mean not being able to afford the home you really want.

Bring your financial documents with you when you visit lenders. Getting to your bank without your last W-2, check stubs from work, and other documentation can make your first meeting short and unpleasant. The lender wants to see all this material, so keep it nearby.

You should know that some mortgage providers sometimes approve clients for loans they cannot really afford. It is up to you to make sure you will be able to make the payments on time over the next years. It is sometimes best to choose a smaller mortgage even though your mortgage provider is being generous.

Do not let a single mortgage denial keep you from searching for a mortgage. One lender's denial does not doom your prospects. Check out all of the options and apply to those which best suit you. Finding a co-signer may be necessary, but there are options for you.

If you've gotten approved for a mortgage, don't make any other big purchases until after you've closed on your home. Typically your lender will pull your credit once again right before closing. If there are issues that crop up it could lead to problems with your closing. Be smart and curb spending until all is complete.

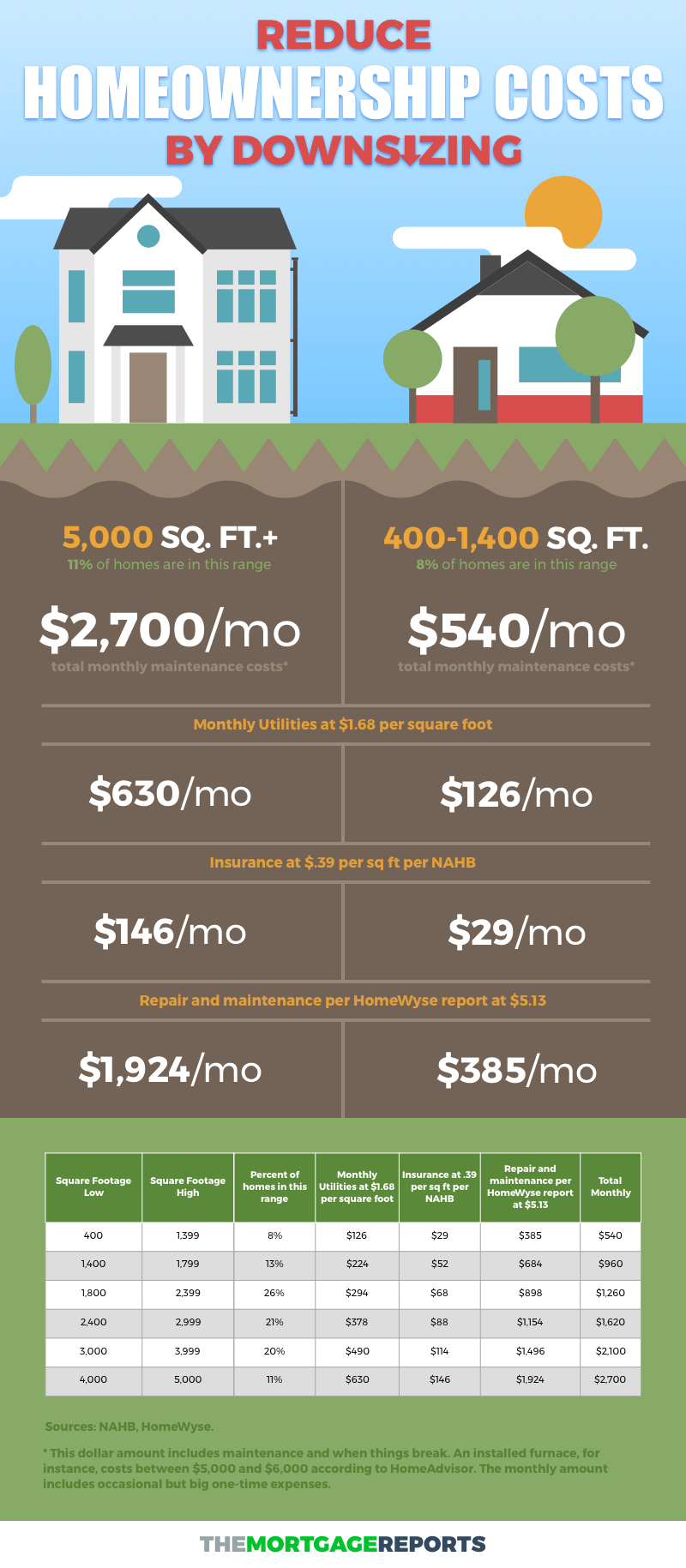

If you have previously been a renter where maintenance was included in the rent, remember to include it in your budget calculations as a homeowner. A good rule of thumb is to dedicate one, two or even three perecent of the home's market value annually towards maintenance. This should be enough to keep the home up over time.

Answer every question on your home mortgage application absolutely honestly. There is no benefit in lying, as all of the information that you provide will be thoroughly examined for accuracy. Additionally, a small fib could easily lead to your denial, so just be honest from the start so that you have the best chances.

Remember that your mortgage typically can't cover your entire house payment. You need to put your own money up for the down payment in most situations. Check out your local laws regarding buying a home before you get a mortgage so you don't run afoul of regulations, leaving you homeless.

Do not take out a mortgage loan in order to buy the most expensive home on the block. While that may seem like a good idea, it can have a negative impact on your financial future. Since home values are calculated based on all of the homes around them, which means that later on you may have a hard time selling it for its full value.

When rates are near the the bottom, you should consider buying a home. If you do not think that you will qualify for a mortgage, you should at least try. Having your own home is one of the best investments that you can make. Quit throwing away money into rent and try to get a mortgage and own your own home.

Think about finding a mortgage that will let you make bi-weekly payments. Doing this allows you to make two extra payments each year, which can greatly reduce the amount that you pay in interest over the term of the loan. It is also ideal if you get paid every two weeks, as you can have the payment automatically draw from your bank account.

Know the real estate agency or home builder you are dealing with. It is common for builders and agencies to have their own in-house financiers. Ask the about their lenders. Find out their available loan terms. This could open a new avenue of financing up for your new home mortgage.

Don't feel relaxed when your mortgage receives initial approval. Avoid making any changes to your financial situation until after your loan closes. Even after you secure a loan, the creditor could check out your credit score. If you open up a new credit account or get a car loan, the lender can cancel the home loan.

How flexible is the payment schedule being offered to you? With greater flexibility comes the ability to pay off your mortgage more quickly, but it may also include higher interest rates. Consider how much you will spend over the entire life of the mortgage as you compare your options.

You won't have to take classes on bank loans to understand enough about home mortgages. All you need is some simple and practical advice, like the tips you have read in the above text. If you can approach the subject with enough knowledge, you should be able to obtain a great mortgage loan.